Industrial Lime Production: A Strategic Imperative

While the world continues to industrialize, Vietnam’s lime production industry remains largely manual and outdated. Transitioning to industrial-scale production is no longer a choice—it is an urgent necessity and an inevitable trend. Enterprises and investors with access to raw materials, modern technology, and advanced equipment must begin preparations to capitalize on this critical opportunity.

Industrial Lime: The Backbone of Multiple Sectors

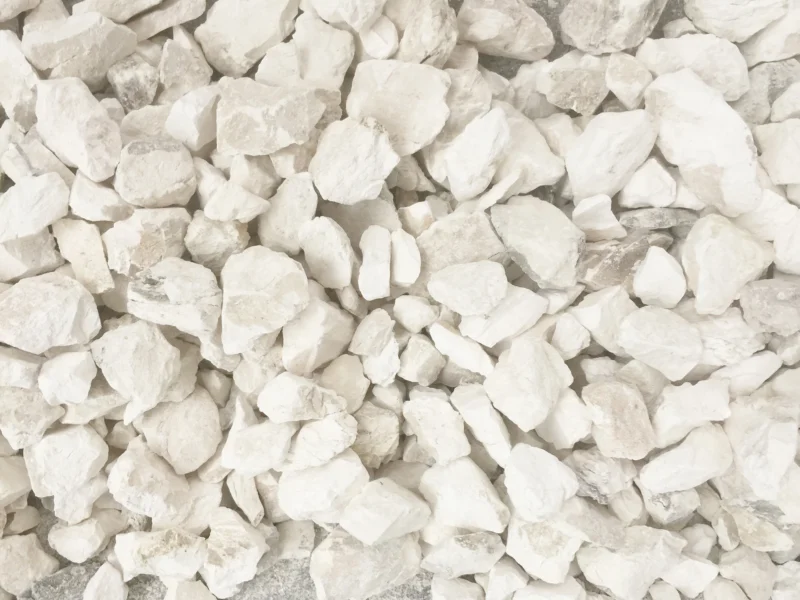

As Vietnam enters its next phase of economic growth, industrial lime emerges as a foundational product underpinning numerous industries. Used since ancient times in construction, lime today is indispensable across sectors such as metallurgy (particularly steel manufacturing), agriculture, food processing, cement production, and environmental treatment. It is one of the most widely applied chemical materials in modern industry.

For instance, crushed limestone is used in coal mines to suppress dust and minimize explosion risks. In agriculture, lime improves soil pH, enhances microbial activity, and supports nutrient release. In aluminum production, it removes silica from bauxite ore. In construction, lime is vital for producing silicate bricks, insulation, mortar, and concrete with superior properties.

In food and sugar processing, lime clarifies raw sugar juice and extends produce shelf life. It neutralizes industrial acids, preventing corrosion and protecting ecosystems. In water treatment, lime eliminates impurities like silica, manganese, and iron, and is key to disinfection and softening processes.

Pulp and paper industries rely on lime to recover caustic soda and bleach pulp. Lime also aids in decomposing non-cellulose components of straw in board manufacturing.

Most critically, lime plays a vital role in pollution control. It removes sulfur dioxide from industrial emissions and treats wastewater by eliminating organic matter and heavy metals. It is also used in steel manufacturing to eliminate phosphorus, sulfur, and silica, and to prevent sticking in cast iron molds.

Industrial Lime Production Remains Underdeveloped

Despite possessing large reserves of limestone suitable for industrial-scale cement and lime production, Vietnam’s lime manufacturing sector remains modest and underdeveloped. According to geological surveys, the country has identified 633 limestone deposits, including 351 deposits designated for cement production (approximately 44.74 billion tons), 227 for construction aggregates used in concrete, roads, bridges, and culverts (approximately 7.69 billion m³), and 55 dolomite deposits (approximately 2.67 billion tons).

Currently, Vietnam has only around seven operational lime production lines, most of which utilize outdated technology and exhibit low levels of mechanization. These facilities include:

-

An Hoa Paper Mill (200,000 tons/year, rotary kiln technology)

-

Duc Thai Joint Stock Company (150,000 tons/year, vertical kiln technology)

-

Hoa Phat Steel Joint Stock Company (150,000 tons/year, vertical kiln technology)

-

Savina Joint Stock Company (60,000 tons/year, vertical kiln technology)

-

Vietnam Lime One Member LLC (150,000 tons/year, vertical kiln technology)

-

Chu Lai Soda Ash Joint Stock Company (350,000 tons/year, rotary kiln technology)

-

Tan Thanh My Joint Stock Company (40,000 tons/year, vertical kiln technology)

Due to technological limitations, lime produced in Vietnam often suffers from inconsistent quality and is primarily suited for industries with low or non-stringent technical requirements. As a result, Vietnamese lime commands relatively low prices in the market.

To address these shortcomings and modernize the sector, the Ministry of Construction has approved the Master Plan for Lime Industry Development to 2020, with an orientation toward 2030. The plan is being implemented nationwide, across six economic zones, with priority given to provinces rich in limestone potential, such as Thai Nguyen, Hai Phong, Quang Ninh, Ha Nam, Ninh Binh, Thanh Hoa, Quang Binh, Tay Ninh, and Kien Giang.

The development strategy aims to produce high-value, stable, and environmentally sustainable lime products through the efficient use of resources and the adoption of alternative raw materials and green technologies. New production facilities must meet strict investment criteria, including:

-

Kiln capacity of at least 200 tons/day

-

Heat consumption under 900 kcal/kg

-

Electricity usage under 30 kWh/ton

-

Dust emissions below 30 mg/Nm³

Implementation Roadmap

For the 2016–2020 period, the plan set the following targets:

-

Maintain and upgrade existing mechanized lime production lines, reaching a total output of approximately 4.3 million tons per year.

-

Expand capacity by investing in 17 identified projects with a combined designed capacity of 3.46 million tons per year.

-

Reserve development potential in 17 additional projects that have not yet secured investors, representing another 1.2 million tons per year in designed capacity.

By 2020, the total designed capacity was projected to reach approximately 8.96 million tons per year. Looking ahead, Vietnam aims to expand industrial lime production to meet domestic and export demand, which is forecast to reach around 10 million tons per year by 2030.

However, some industry stakeholders warn that without firm and coordinated action from local governments and regulatory authorities, the roadmap risks stalling—potentially resulting in a collapse of the industrial lime market.